It is all very well making the effort to establish the operating and free cash flow for a business, but what do you then do with this information? It is important to understand whether the big capital investments made to generate an operating cash flow actually exceed that cash flow or provide sufficient return to justify the capital investment. The distinction here is that even though a business may produce good operating cash flows from its daily operations, the cost of maintaining or buying new equipment, say, every 5 years, may actually turn a business with good operating cash flows into a business that loses money at the free cash flow line.Ĭonversely, a business that makes only moderate operating cash flows but employs little to no capital in making those operating cash flows may actually produce an acceptable free cash flow. Large discrepancies in these numbers can often spell trouble, or at the very least, they need to be carefully explained by management.įree cash flow is derived from the operating cash flow outlined above and then takes into account major expenditures on, for example, property, plant and equipment, the purchase or sale of a business and major expenditure on maintaining or growing business assets. At a basic level, the process of reconciling cash flows to profits involves a closer look at revenues, expenses, debtors, creditors and inventory, or stock in hand. The process of reconciling profits to operating cash flows can help prevent large investment errors. This is why we pay particular attention to big differences in reported profits and reported operating cash flows. If a business does not produce cash flow then there is a good chance it will not be around in the long run.

You often hear investors say “cash is king,” and in the end, cash is king. Rent received would be lower than interest paid and the property revaluation produces no cash. The property trust in this example would in fact produce a negative operating cash flow. The company has paid cash for goods but not received any cash in return yet.Ī property trust may buy properties with debt and rent them out to tenants at yields lower than the interest rates on debt, then subsequently revalue the properties upwards by, say, 10%, thus producing a “healthy” profit. In fact, in this example the operating cash flow would be negative.

While this strategy may deliver a good profit, it does not produce any operating cash flow. This can be very different to the profit a company generates.Ī company may sell many products in a year and offer credit to customers to buy those products, which they have purchased from suppliers. Operating cash flow measures the amount of cash a company generates from its daily operations. Karl Siegling, Managing Director and Portfolio Manager at Cadence Capital Limited believes that cash flow is the most important of all the fundamental measures commonly used by the investment industry.

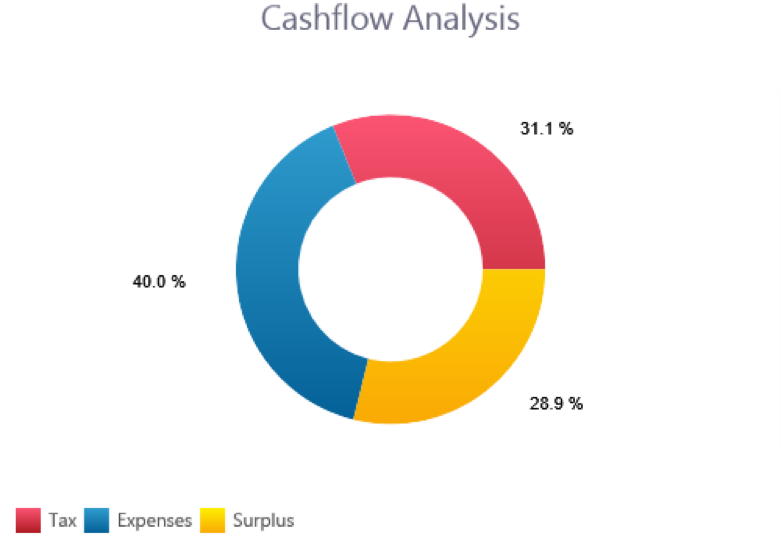

Unlike an income statement, a cash flow statement will reveal if the company is generating cash. Cash comes in from customers/clients and goes out in the form of payments for expenses, rent, taxes etc. Investors rely on the statement of cash flows to determine a company's financial strength.Ĭash flow is the money that is moving in and out of your business.

0 kommentar(er)

0 kommentar(er)